Audrey’s been wanting, no let me rephrase that, absolutely yearning to go to Antarctica for a couple of years now. For months she’d periodically ask me, “So when are we going to Antarctica?” Like any good husband I’d say, “We’ll see.”

I knew that visiting Antarctica was going to be expensive. We had to develop a realistic savings plan in order to make her dream come true. I advised her to start an Antarctica savings account and she began saving $200 per month for numerous years.

Believe it or not, we actually booked the trip a few weeks ago! We’re officially heading out to the great white continent on November 16th, 2014. This was officially the moment when we committed 100% to our RTW trip. No matter what’s going on in our lives, we have to be in Ushuaia in November.

Like any good B$ Traveler, we strategically paid off Antarctica with newly issued credit cards in order to take advantage of the bonus miles. If people want to know how to verify someone before they start banking online, they can check it out here!

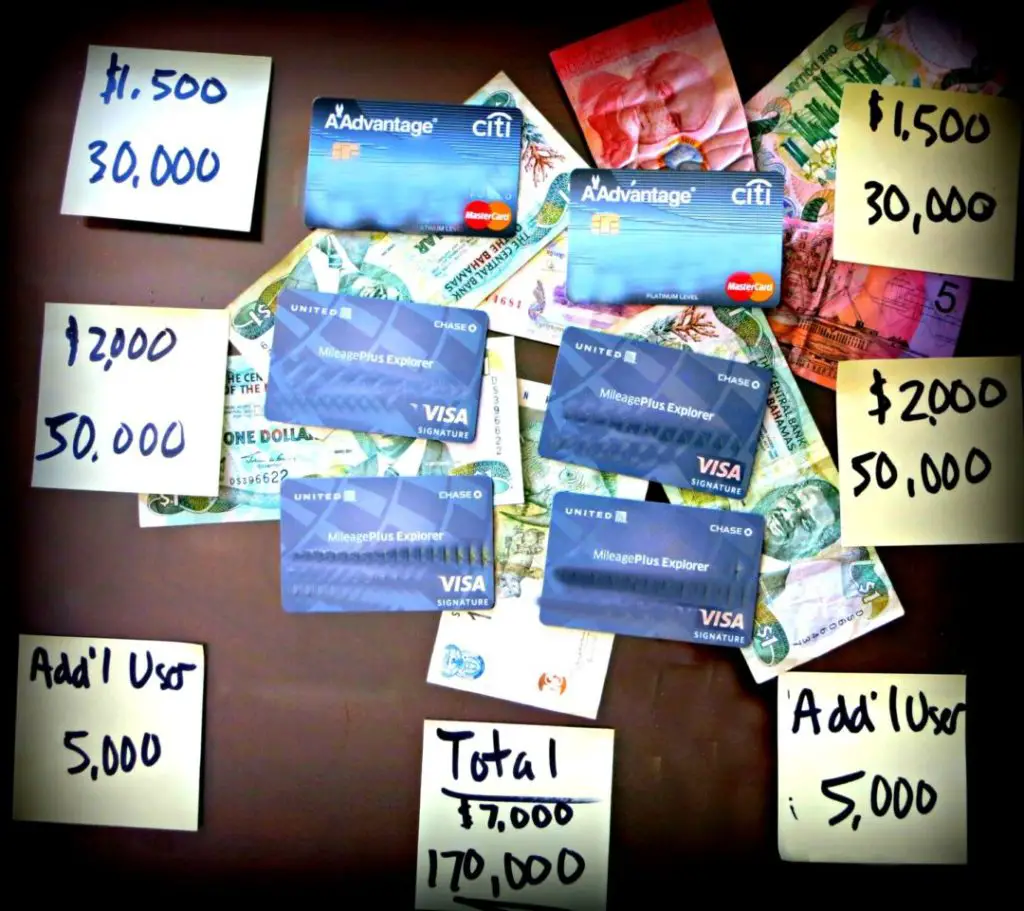

We opened two different credit cards each:

- 1) Citi to earn 30,000 American Airlines miles. The 2 AA cards needed minimum purchases of $1,500 and the 2 United cards needed $2,000. (We charged these amounts covering a chunk of the cost for our Antarctic trip.)

- 2) Chase to earn 50,000 United miles. Chase also offered an additional 5,000 miles for adding an authorized user (which we earned just by buying two cups of Audrey’s favorite, Dunkin Donuts coffee).

AA: 30,000 x 2 = 60,000 miles

United: 50,000 x 2 = 100.000 miles

Adding Additional User – United: 5,000 x 2 = 10,000 miles

Total Miles = 170,000

As of now, our first stop will be Buenos Aires. We’re seeing flights from Chicago to Buenos Aires for only 20,000-30,000 miles for each passenger.

There are very few moments when you can get something for almost nothing but this is definitely one of those moments. A few things to keep in mind:

- Most likely the card will have an annual fee. Make sure to verify whether this fee is waived the first year and to close the card prior to the one year anniversary to avoid this fee.

- There’s probably some cool additional benefits to having these cards that you should look into. Make sure to read the card member benefits pamphlet that accompanies the card.

- Keep in mind that you’ll likely lose any remaining miles once you close the account. In other words, use’em or lose’em.

We Need Your Help

Did you find this article helpful? If so, bookmark it and when you’re planning your next vacation, click on any of the links below before finalizing reservations. You’ll get the best price, we’ll earn a small commission, and you’ll help support future articles.

Thank you!

BEST TRAVEL SEARCH ENGINES

🏘️ Book Accommodation

We use Tripadvisor to compare prices and reviews in advance and check availability

✈️ Book Your Flight

To find the cheapest flight options, use Skyscanner to find the most suitable choice for you

🚗 Reserve Rental Car

Use Discover Cars to compare prices and view the largest selection of vehicles